Kodiak Cakes Selects BluePlanner TPM

Kodiak Cakes, maker of whole grain and protein-packed breakfasts and snacks, has select...

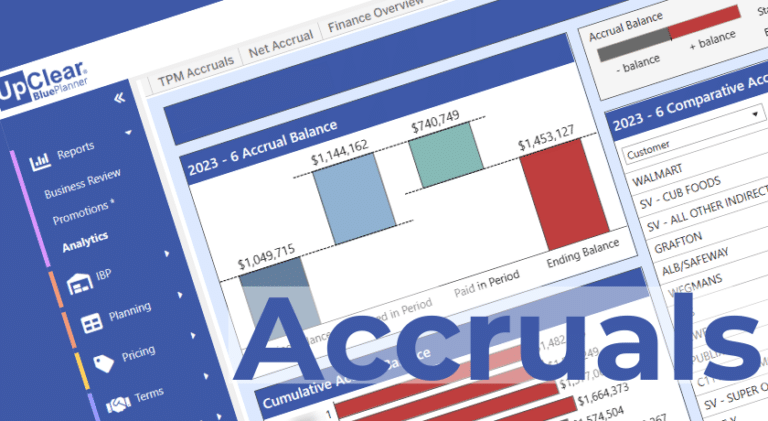

The generally accepted accounting principle (GAAP) of “periodicity” states that “entries should be distributed across the appropriate periods of time.” In the Consumer Goods industry this gets tricky because transactions take place at many different times. The “appropriate period of time” is often different than the transaction date. The goal is to report the expenses in the period when they occur as opposed to when they are paid.

An accrual is a journal entry that is used to recognize revenues and expenses that have been earned or consumed but not yet received or paid out. Billback, scan, and fixed fee transactions (deductions) usually take place after the promotion has been executed. Following GAAP, the expense should be reported in the promotion period. The lag between the promotion execution and the transaction (deduction) ranges from weeks to months. The Trade Accrual both recognize the incurred but unpaid expense and aligns it with the performance date, not the transaction date.

Absent a tool that helps with this task, trade accrual forecasting is a manual exercise that typically includes identifying last year’s spending and determining adjustments for changes in the current period. When a brand has few customers, SKUs, and promotions, the manual process works. It is a relatively simple exercise that can be completed quickly.

As a brand grows, however, complexity also grows. The risk of a P/L expense swing from month to month increases significantly. Unfavorable swings are surprises that can significantly impact financial performance.

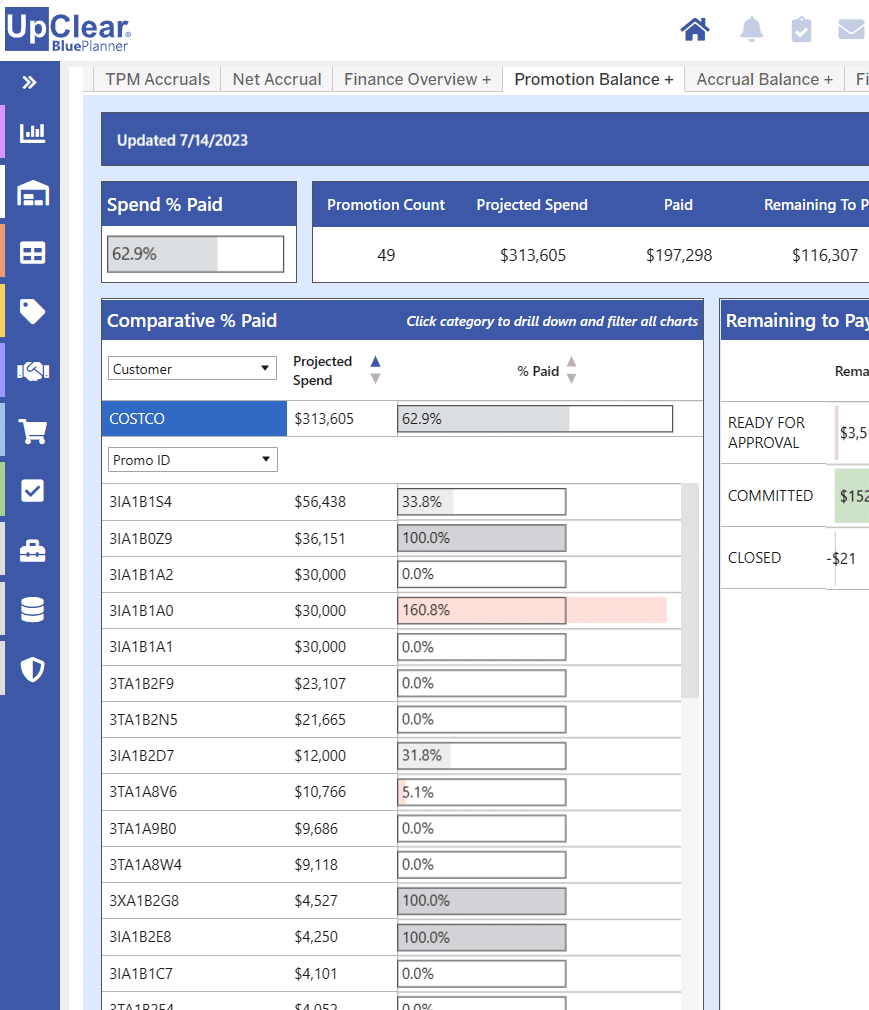

A tool that helps Consumer Goods Finance teams increase the speed and accuracy of trade accrual forecasting is Trade Promotion Management (TPM). The primary users of TPM are Key Account Managers that plan promotion spending and Deduction Analysts that validate and categorize deductions by matching them to promotions or non-promotion expense types (like damages). Information is then provided to Accounts Receivable (AR) to clear deductions.

Here’s how TPM helps Finance with the trade accrual:

Use of TPM transforms the determination of the trade accrual from what is probably a mostly manual process that relies on information from different sources and assumptions to one that is systematic, automated, and based on the actual activity in the period.

Off-invoice (OI) allowances are used to execute customer agreements like everyday low price (EDLP) allowances. OI allowances reduce the invoice price to the customer. While this is categorized as trade spending, it is not part of the trade accrual because OI transactions take place when the product is shipped. There is no need for an accrual because the expense has already been recorded.

Since OI doesn’t require an accrual, why not use it for everything? Three reasons: 1) OI exchanges money for every case you ship. Some of this product may not be sold on promotion, thus you subsidize and reduce profitability on non-promoted sales. A better option is a scan allowance. With a scan, you only get charged for the allowance on sales to shoppers that are “scanned” through the cash register…you pay only for performance. 2) Some forms of trade spending, like ad and display fees are fixed sums of money and cannot be executed using OI. 3) Some customers buy their product from distributors, but negotiate promotions with you (AKA indirect retailers). You don’t sell to them so you can’t give them an OI allowance.

There are two dynamics that trigger a search for a TPM solution. One is a need for greater structure, control, and efficiency. The brand has outgrown spreadsheets, email, and shared files for management of their sales processes. This is usually driven by growth in customers, products, promotions, transactions, and people involved in the process. TPM helps because it is a business system built around the Consumer Goods sales process. Trade accrual forecasting typically fits into this category.

The second is the transition from a go-to-market strategy of maximizing sales to one of maximizing profit. With this transition comes a greater need to scrutinize distribution and promotion investments. This requires more understanding of where money is being spent, how it is being spent, and if the results are good or bad. TPM helps because it organizes data in a structured, standard way that enables fast analysis of business performance.

Excel is definitely the tool of choice for Consumer Good brands for accrual forecasting until it becomes “a cruel” exercise (sorry). Deployment of a Trade Promotion Management system will provide greater insight into trade spending, improve accuracy of the accrual, and help you avoid surprises that swing company profitability.

UpClear makes software used by Consumer Goods brands to improve the management of sales & trade spending. Its BluePlanner platform is an integrated solution supporting Trade Promotion Management, Trade Promotion Optimization, Integrated Business Planning, and Revenue Growth Management.

Kodiak Cakes, maker of whole grain and protein-packed breakfasts and snacks, has select...

BluePlanner was taken to the market 15 years ago. Over this time, the majority o...

Vytalogy Wellness, a modern wellness company formed by merging the brands Natrol and Ja...