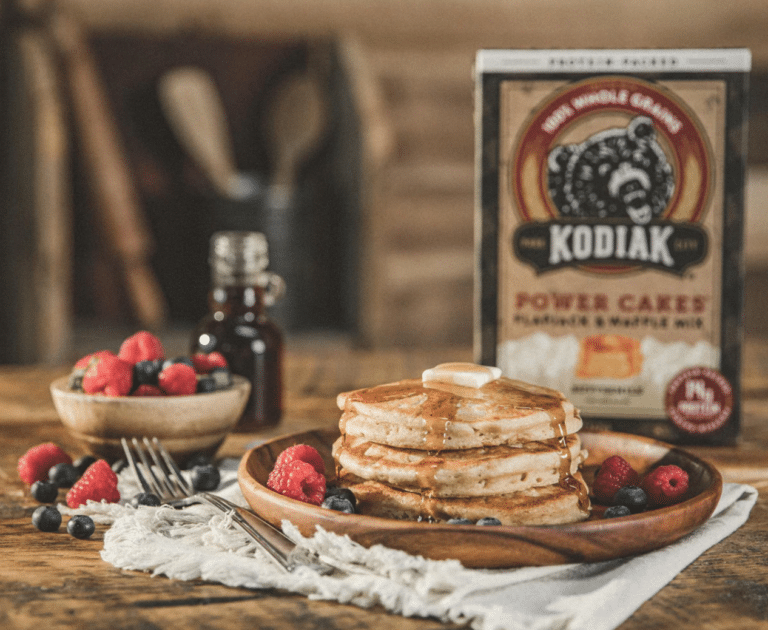

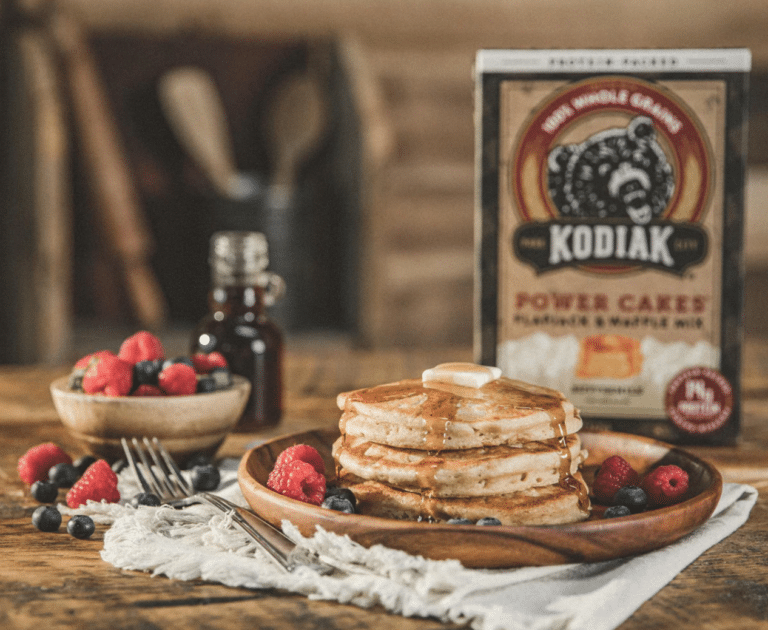

Kodiak Switches to BluePlanner Trade Promotion Management (TPM)

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

Whenever a consumer goods brand deploys a solution for trade promotion and optimization, the value of having a single price list in TPM systems has always been clear and universal. Without a single price list, it is next to impossible to truly evaluate your real trade spending from a macro or even micro level.

Generally, the reasons for not having a single price list have more to do with the setup and configuration of the ERP system than the sales department not wanting such a list. The fact is, in many countries, this is the law. Not having a single starting price would be considered unethical.

Let’s look at it a little differently. Does your company have different/competing standard costs for a product? Does the standard cost change depending on the customer that it’s sold to? Of course, it doesn’t, as that wouldn’t make any sense. A single standard cost allows you to perform standardized profitability analysis, regardless of who purchases your products. The same should be true for the selling price.

Consider the example of not having a single starting price list for a product:

By not having a starting price list, the Rate-per-Case (RPC) discount appears to be a much smaller percentage of the price than it truly is. Without a single price list, how will you account for the price adjustment? Many would argue that the price adjustment is not trade spending, but most governments, as well as external auditors, would differ on that opinion. The reason for giving a lower price to a customer is generally a trade related factor (eg. the size of the expected sales) and, therefore, the difference in the price should be treated as trade spending.

Consider the example where the same product is sold to 2 different customers with the same Rate-per-Case (RPC) discount:

By giving the same discount to customers that have different pricing without a single price list, the true depth of discount changes per customer.

Now, consider the implications when you’re the brand manager attempting analysis on a single product across all of your customers. Some of the key metrics that help you determine profitably, like ‘spend per case’ and ‘margin %’, cannot be performed.

On an even darker note, true trade spending is often buried into the customer price and would, therefore, not be correctly accounted for. There are CPG companies that have buried almost all their trade spending under the customer price to such a degree that products were selling for vastly different amounts. The reason for the pricing at most of their customers had long been forgotten and did not make any sense to current account managers. A large customer today could quickly become a small customer tomorrow and, by burying customer discounts under the customer price, you have very little visibility or leverage to change prices to reflect changes in the customer’s business with you.

In conclusion, it would be advisable to move to a single price list approach for your business and track spending with greater rigor and accuracy.

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

BluePlanner was taken to the market 15 years ago. Over this time, the majority o...

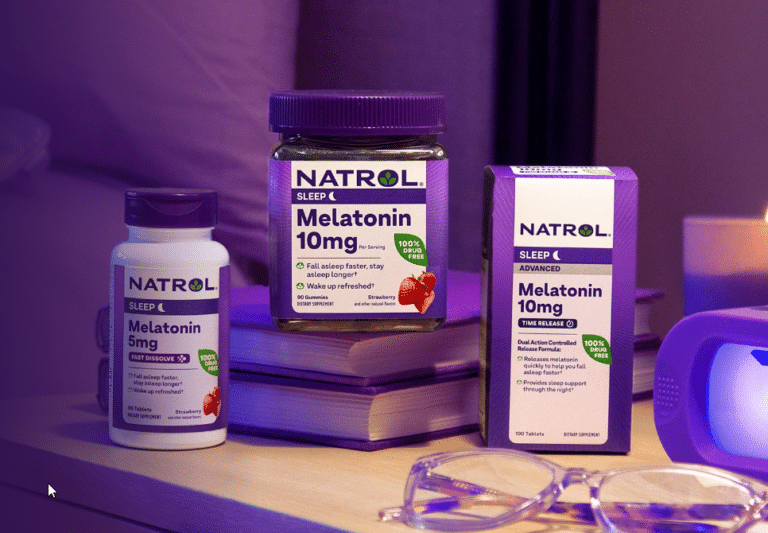

Vytalogy Wellness, a modern wellness company formed by merging the brands Natrol and Ja...