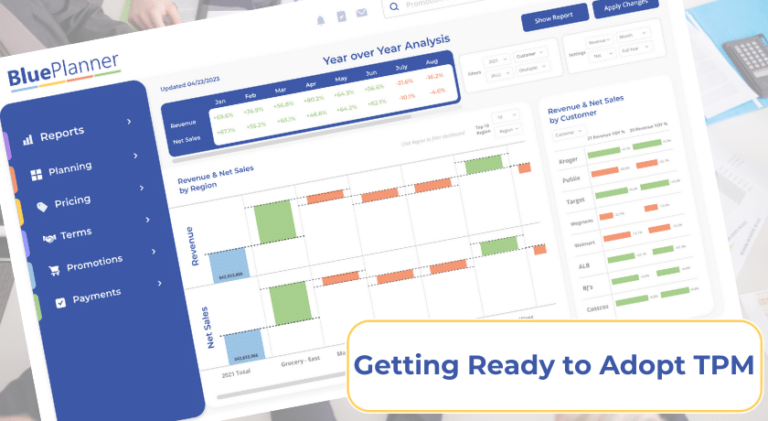

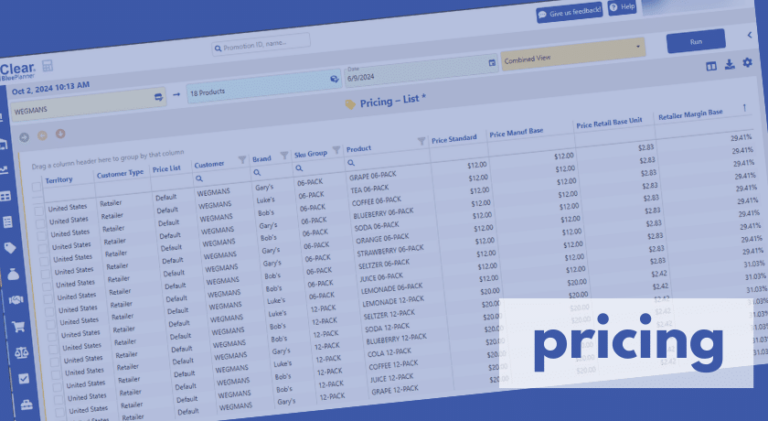

Finance uses BluePlanner to more accurately forecast the trade spending accrual and ensure that customer sales & promotion plans align with the company’s financial objectives and do not lead to overspending or negatively impact margins.

As a finance professional working in the consumer goods company, you would be well-versed in the complexities of trade promotions. The sales and marketing teams play a significant role in driving trade promotions. Still, as a finance professional, you need to ensure that these promotions align with the company’s financial objectives and do not lead to overspending or negatively impact margins.

This is where BluePlanner comes in. BluePlanner is a software-based solution that helps the finance department accurately forecast the month-end trade accrual. BluePlanner is a centralized platform that provides an integrated view of all customer sales, spending, & trade promotions, providing visibility into performance metrics, budgets, and expenses incurred.

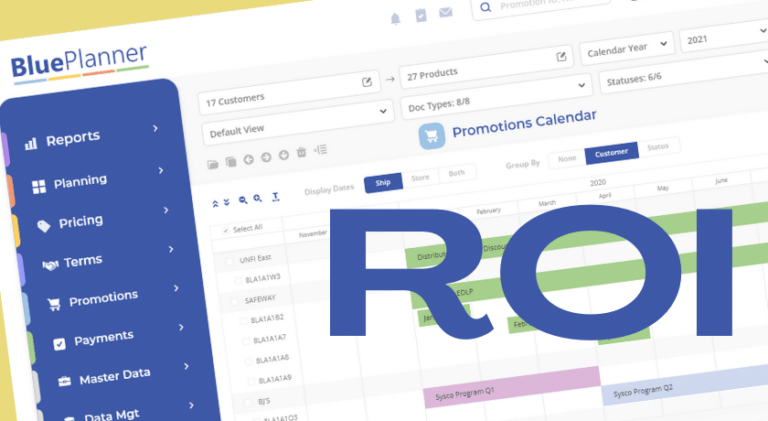

Using BluePlanner, a finance professional can view the customer plans created by the sales and marketing teams and analyze them in real-time. By doing so, you can identify discrepancies and inconsistencies in the plan, helping you make decisions regarding the accruals for the month. BluePlanner also provides a detailed view of the expenses incurred by the company at each stage of the promotion, enabling you to take proactive measures when costs escalate beyond the budgeted amount.

One significant benefit of implementing BluePlanner is the ability to optimize trade promotions. With this system in place, finance professionals can forecast the impact of promotions on demand, revenue, and margin. This enables them to optimize the promotions by determining the best time to offer them, which products to promote, and the optimal discount rate. With such insights and data, the finance team can make better decisions that will result in revenue growth.