Kodiak Switches to BluePlanner Trade Promotion Management (TPM)

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

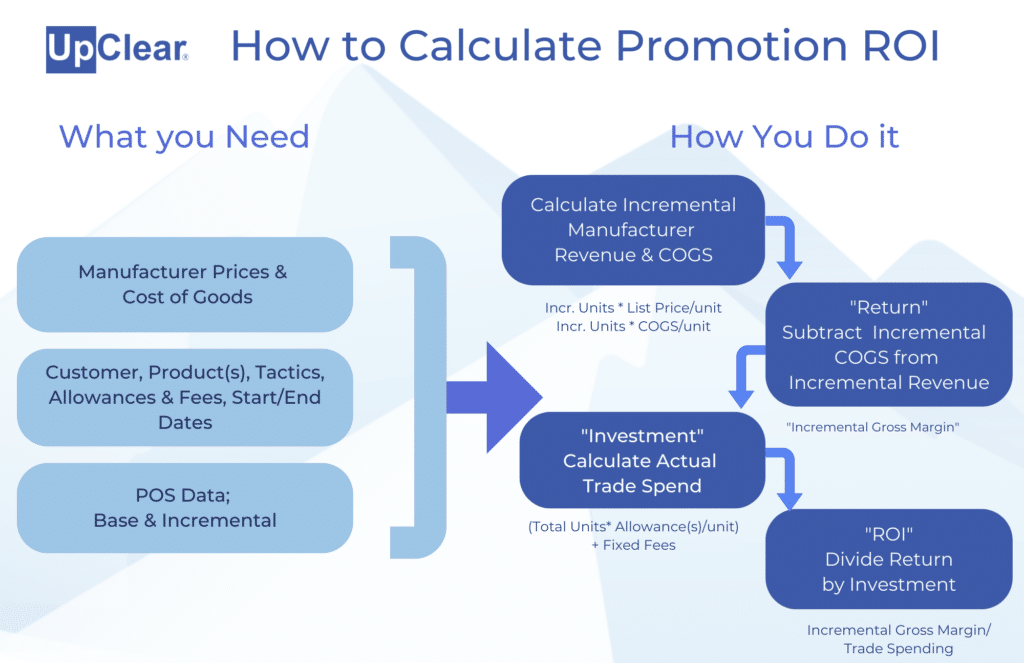

A true Return-on-Investment (ROI) calculation is the holy grail of promotion key performance indicators (KPIs), but CPG companies struggle to understand both the forecasted ROI when planning a promotion and the actual ROI for promotions that have run. So, how do you create the proper processes to calculate ROI?

To be successful, it’s important to understand one fundamental requirement: You must have forecasted and actual base volume. Why? Because the “return” in ROI is the “extra” sales (incremental) you attribute to the promotion tactics that are used: reduced prices, displays, advertising. To calculate incremental, you need to establish what sales are when promotion offers are not present.

Read on to understand the information you will need to calculate the ROI of a promotion, and how to do it.

Step #1 – Determine ‘Base’ Volume. The first decision point here is the type of volume you are using in the ROI calculation: shipments or retail sales (AKA POS, consumption). We recommend using retail sales as the volume basis so that the KPI reflects the effectiveness of the promotion offers to the shopper. If that is not possible, use shipments in your ROI calculation.

The goal in defining base volume is to establish how many units will be sold at their everyday price with no display or advertising. There are multiple methods for establishing base volume:

Step #2 – Determine the two ends of a promotion. There are different dimensions to this. The first dimension is volume. As previously stated, you need to define the type of volume you’re using for promotion measurement and window of promotion. E.g. If this is retail sales, it is the start and end date of the promotional offers to the shopper. The second dimension is spending. The “investment” input to the ROI calculation needs to include all spending that supports the promotion. If this is a scan allowance, you must calculate the spending during the dates of the shopper offer. If the spending is a billback or OI, you must consider the spending that occurred during the shipment window of the promotion.

Step #3- Calculate “Return.” Return is the gross margin earned by the “extra” or incremental sales. To calculate this, you subtract base volume from total to identify incremental sales. You then, 1) calculate Incremental Gross Revenue by multiplying incremental sales by the list price of the product, and 2) calculate Incremental Cost of Goods Sold (COGS) by multiplying incremental sales by the COGS factor for the product(s). Return is calculated by subtracting Incremental COGS from Incremental Gross Revenue.

Step #4- Calculate “Investment.” Investment is spending required to generate the Return. For this calculate the total variable allowances (scans, OIs, billbacks) and fixed fees. Decide if you want to include EDLP in the investment. Determine if you want to include all EDLP or just incremental EDLP. Make sure you do this across customers.

Step #5- Calculate ROI. Divide the Return by the Investment.

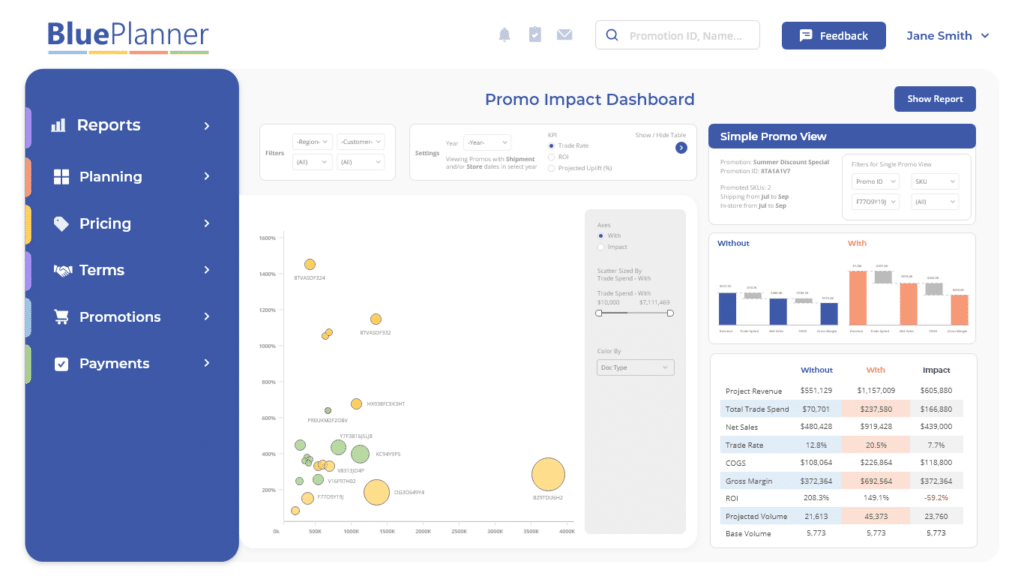

Software like BluePlanner TPM by UpClear automates the management of the data, calculation of KPIs, and creation of reporting that enables you to understand the performance of promotions.

To see more on calculating ROI on promotions, see How to Calculate Promotional ROI – Start With 5 Key Building Blocks.

UpClear makes software used by Consumer Goods brands to improve the management of sales & trade spending. Its BluePlanner platform is an integrated solution supporting Trade Promotion Management, Trade Promotion Optimization, Integrated Business Planning, and Revenue Growth Management.

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

BluePlanner was taken to the market 15 years ago. Over this time, the majority o...

Vytalogy Wellness, a modern wellness company formed by merging the brands Natrol and Ja...