Iconic tea manufacturer Twinings North America receives around 3,000 deductions from the distributor KeHE every year. Industry consultants have reported that across brands & customers, 17% of deductions they process are invalid. Left unchecked, this is pure profit erosion for brands. There is, however, a fine balancing act between investing in the cost of finding and disputing invalid deductions versus the dollar value of the erroneous charges. When you can optimize the investment you make in deduction management, you create time to maximize what you get out of the work. Read on to learn how Twinings North America put capabilities in place to eliminate 80 hours of work for just one customer.

“…It’s really just been a great process… they are two great systems that were both individually giving us a lot of benefits…so combining them has really just enhanced the benefit we get from both systems”

-Lauren Leiman, Commercial Finance Director NA- Twinings NA

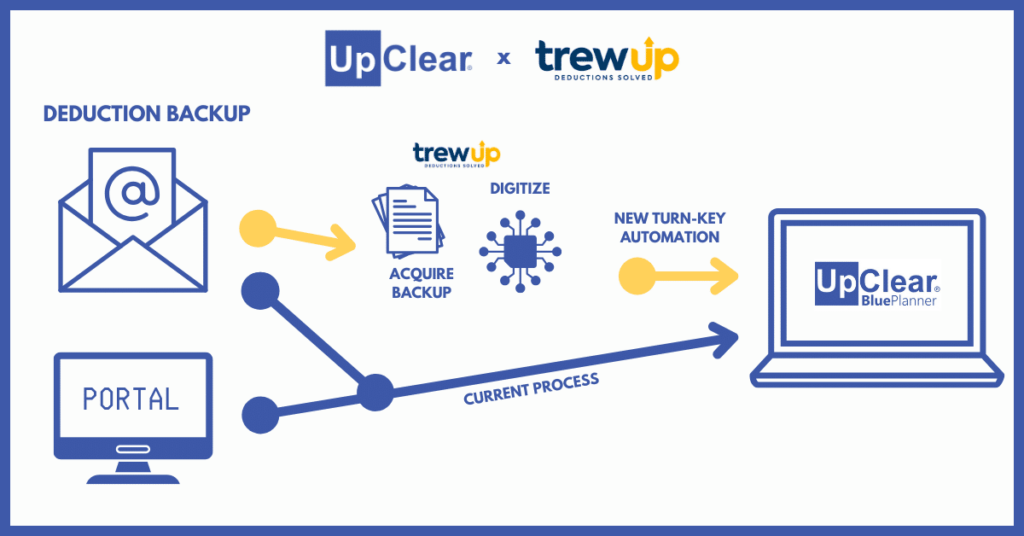

Among other systems and tools, there are two purpose-built solutions used by Twinings North America in the deduction management process. First, UpClear’s BluePlanner TPM is used for account sales & promotion planning as well as deduction management. BluePlanner is integrated with Twining’s ERP system. In deduction management, the BluePlanner is used to record the validation or dispute of deductions by matching them to promotions or other contractual agreements. This also does three important things:

The second solution used by Twinings North America is TrewUp. They acquire deduction backup documents (usually in a PDF format) digitize the document and transform it into a structured data set that categorizes deductions and produces analytics that enable type and trend analysis across customers & products.

UpClear and TrewUp joined forces to use more AI to eliminate manual work from the deduction management process. TrewUp automatically sends the deduction backup document and data to BluePlanner. BluePlanner then automatically imports these and attaches them to the deduction record. According to Lauren Leiman, Commercial Finance Director for North America, the collaboration is paying dividends.

“It’s working really well for us…we definitely got a lot of time savings and efficiency by only having to be in one system and having everything in one place. We are estimating it will probably save us close to two weeks in just the manual pulling of data…time that can be used to do research when needed, match up deductions, and keep our open AR balances low.”

UpClear makes software used by Consumer Goods brands to improve the management of sales & trade spending. Its BluePlanner platform is an integrated solution supporting Trade Promotion Management, Trade Promotion Optimization, Integrated Business Planning, and Revenue Growth Management.