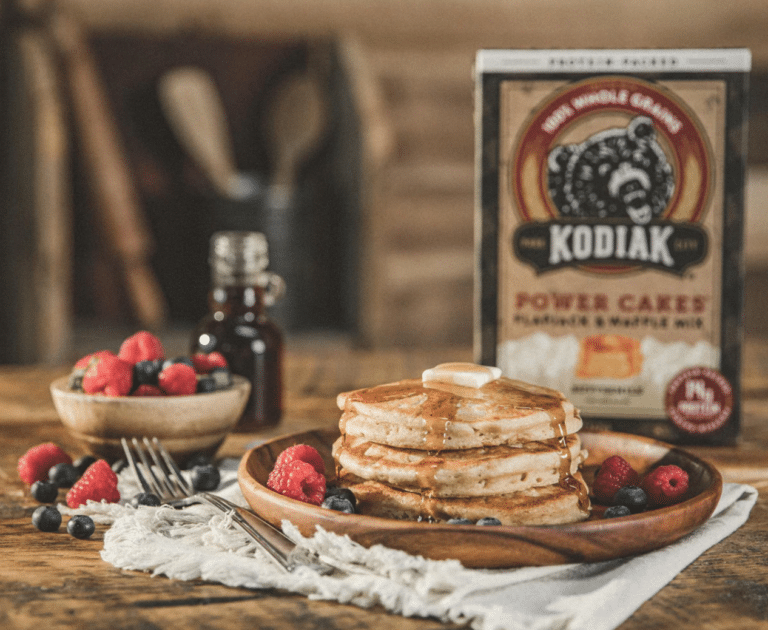

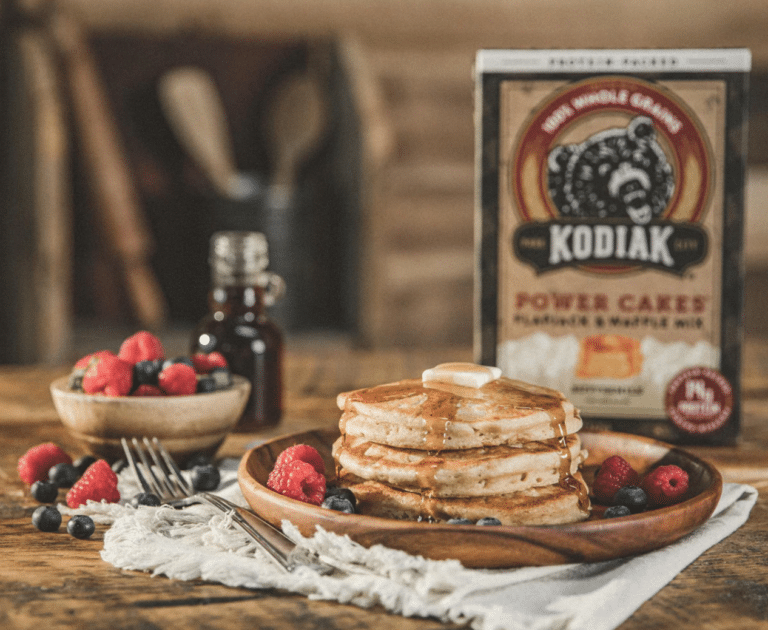

Kodiak Switches to BluePlanner Trade Promotion Management (TPM)

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

The money you spend on promotions -trade spending – is like the kind of tidal wave that big wave surfers search for. These waves start out small but grow into monsters as conditions change in an environment that is conducive to chaos.

If you haven’t ridden the wave yet, this article will help you understand what conditions lead to the growth of trade spending and business process complexity. If you’re on a wave now, you’ll learn strategies that will help your team ride it with confidence.

As all waves do, this customer-specific spending wave starts out small, but builds over time as conditions change. What makes up this wave includes money for customer promotions (MCBs, scans, ad/display fees), customer marketing, expenses to get your product into distribution (slotting, freefill) , and operational expenses(damages, fees for shortages, fines for late deliveries). It’s worth noting that not all of these expenses are valid. Customers make mistakes, so it is the brand’s responsibility to identify mistakes and get them repaid. The size of the wave at its peak is staggering. The promotion expenses alone are likely to grow to 25% of your gross revenue.

Just like the ocean is affected by storms in the atmosphere, the trade spending tidal wave is influenced by dynamics in your business. You will see the wave begin to build as you acquire more customers and run more promotions.

When this happens there are more and more tasks, communications, transactions, and usually more people involved in the process. What was once easily managed, quickly becomes stacks and stacks (paper or virtual) of customer invoices that must be processed, and more and more dollars going out the door.

If you’re not prepared, this wave will wipe you out. In consumer goods, wipeouts come in a few forms. First, and most importantly, is that your margin will erode. Trade and other customer expenses will steadily grow in dollars and as a percent of gross revenue. Increased expenses when revenue does not grow at the same rate results in lower profit.

If this occurs, your leadership will very quickly ask where and how this money is being spent. Most of the time, details like this are spread across different people, systems, and tools… mostly spreadsheets. If you put the right effort into it, you’ll be able to provide an answer, but it will take a while.

Another type of wipeout is the sales team over-extending your resources. We call this going “Point Break.” While there is usually an all-out push for distribution and promotion to drive trial of new products, the money spent on this cannot be limitless. Without adequate controls in place, you risk facing customer commitments for which you are unprepared.

The final potential wipeout is accounts receivable. There is typically a team of one managing receivables and the anti-receivable…deductions. It can get gnarly. With more and more customers, promotions, and operational fines and fees come more and more deductions. Each one takes time to process and validate. Just doing the bare minimum quickly becomes a full-time job. And in the process you are probably throwing away valuable information about where your money is being spent and what you’re getting in return.

Riding the trade spending wave takes a lot of hard work. Here are three tips to help you get started.

When brands encounter the trade spending tidal wave, there are two types of “surfboards” used:

When we talk to brands that choose the former, the reasons we hear include

While there is some truth to each of these, there are also counterarguments.

We all want to be experts in our business. We believe that purpose-built “surfboard” like TPM enables a brand to gain greater expertise about their business. It will also get you that expertise faster than you would get it with spreadsheets, shared drives, and email. TPM will help you avoid wipeouts and ride the wave like a pro.

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

BluePlanner was taken to the market 15 years ago. Over this time, the majority o...

Vytalogy Wellness, a modern wellness company formed by merging the brands Natrol and Ja...