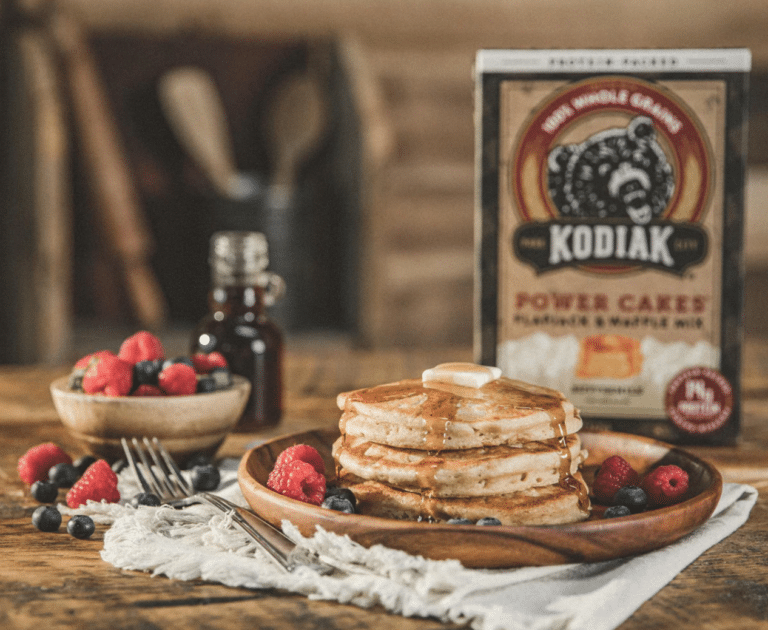

Kodiak Switches to BluePlanner Trade Promotion Management (TPM)

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

In Fast Moving Consumer Goods (FMCG) there is a very familiar progression from a “sell at all costs” philosophy to a point at which distribution and velocity growth has leveled-off and strategy changes. At this point, trade spending very frequently has become a value equal to 25% of gross revenue. There is a shift to prioritizing profitability. Brands turn to a Return on Investment (ROI) metric to decide how to optimize this massive expense. And if you want to calculate ROI, you need base volume. “Return” is the incremental profit created by the promotion. To calculate incrementality, you need a “base” metric.

It is important to note that there are different definitions of and dimensions to “Base Volume.” In one case – often driven by a Demand Planning perspective- “base” is defined as the total sales in some prior period. In this context, planning is capturing assumptions- positive or negative changes- that will cause the present period volume to be different than the “base” period. Another definition – the one relevant to this article- base volume is sales when promotions are not present.

The other important factor to consider is the type of volume being measured- shipments or retail sales. For the purpose of analyzing sales and optimizing trade spending by assessing promotion ROI, retail sales has more benefits and should be the sales data used for base volume whenever possible.

Shipments

Retail Sales

Assuming use of the “sales without promotion” definition and retail sales as the type of sales being measured, there are a couple of ways to think about using base volume.

Unpromoted Sales Trend Across Time

Given a choice, a brand would prefer growth of unpromoted sales over time, i.e. purchases that are not subsidized with trade spending. Insight into this is enabled by reporting that details base and incremental sales across time. With typical drilldown capabilities available today, this kind of report enables you to a) look at the trend of unpromoted sales over time b) see what customers/products are over or under performing. With this topline insight, you can then dive deeper into the reasons for the trends, and more importantly make adjustments improve your trajectory.

Promotion Results

As mentioned earlier, base volume is used in the creation of the promotion ROI metric. When you have a metric for promotion ROI, you can compare results- across products, customers, tactics, seasons, holidays, etc. With this insight you can learn what works and what doesn’t and ideally do more of what works and less of what doesn’t.

There are a couple of sources from which a Consumer Goods brand can get a retail sales base volume: your company’s Demand Planning team, a syndicated data vendor like NielsenIQ or Circana (IRI), consultants or TPM vendor like UpClear, or it can be manually created. For the purposes outlined in this article, the best source of base volume is a consultant or TPM vendor that builds a base volume specifically for the purpose of promotion effectiveness analysis (i.e. ROI). From there, using the same data for trend analysis ensures both types of analyses are based on the same foundational data.

Demand Planning

Syndicated Data Vendor

Consultant or TPM Vendor

Manually Created by Planners

A retail sales-based base volume is arguably one of the most important metrics for analyzing sales in FMCG. Getting a process in place to create and maintain this measurement in a way that is consistent across customers creates a level playing field for comparisons. Then, on this solid foundation you can add analytics that enable you to understand performance and optimize the use of your trade funds.

Kodiak Cakes, maker of whole grain and protein-packed breakfast foods and snacks, has s...

BluePlanner was taken to the market 15 years ago. Over this time, the majority o...

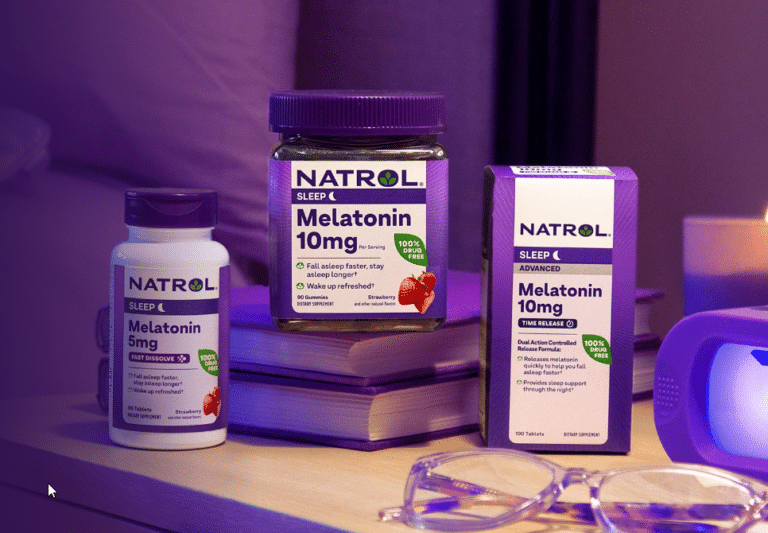

Vytalogy Wellness, a modern wellness company formed by merging the brands Natrol and Ja...