By Ken Accardi

Introduction

For Consumer Packaged Goods (CPG) companies, the Annual Operating Planning (AOP) process is a foundational activity that aligns strategy, spending, and revenue goals across the organization. Among its most complex components is the trade promotion budget—typically the second or third largest item on a manufacturer’s P&L. When managed well, trade dollars can drive volume, market share, and retailer alignment. When managed poorly, they erode margins, create downstream accrual issues, and misalign cross-functional teams.

This paper explores the major components of effective AOP, including Top-Down Budgeting, Guidelines & Guardrails, and Bottom-Up Planning. It highlights best practices, common challenges, and how companies can evolve their processes to be more collaborative, analytical, and agile.

Top-Down Budgeting: Setting Strategy and Financial Targets

The top-down budgeting process typically includes Finance, Revenue Growth Management (RGM), Sales Strategy, and Executive Leadership (VP and C-Level). Sales Account Teams are also often consulted to validate high-level assumptions with customer-level insights. This ensures targets are grounded in marketplace realities while aligned with strategic goals. This process often starts with a fact-based analysis, incorporates changes in strategic direction, and sometimes a little “art” to account for significant subjective issues needed to bridge the gap between historical data and future uncertainties or opportunities.

Best Practices:

- Cross-functional alignment before budgets are released: The most effective companies form a core AOP team consisting of Finance, Strategy, Sales, and Executive leadership. Aligning the strategic approach, roles & responsibilities, modeling methodology, KPI’s and ownership of the end-to-end AOP process is critical. The most efficient AOP Teams also have a well-defined decision matrix, especially the role who holds the tie breaker vote if there isn’t a consensus.

- Use historical performance to inform future plans: Analyze ROI, lift, frequency trends, and margin contributions of past activity.This is a fact-based starting point before layering on any subjective adjustments and should always be used in all modeling scenarios.

- Model multiple budget scenarios to assess risk and reward trade-offs. This is where the “art” part of the process comes in when necessary. Assumptions will need to be made for new product launches not yet reflected in historical data, regulatory changes, strategic bets or changes in leadership vision, and inflation/deflation expectations. These are just a few common examples we see. All subjective adjustments should be documented so executives know what they are endorsing.

- Executive sign-off ensures top-line goals are supported with bottom-line clarity. Formal approval assigns ownership to senior leaders, making them accountable for delivering on the plan and ensuring everyone is working toward the same goals. A formal sign off also provides documentation for internal governance, board reporting and external audits.

Another aspect to consider – is building-in flexibility to allow for a mid-year reforecasting or reallocation if conditions significantly change. Geopolitical changes, events like COVID, inflation and general business uncertainty are good reasons to look at targets mid-year and tweak if necessary.

Industry Tip: In Food & Beverage and Health & Beauty categories, where promotional ROI varies significantly by retailer and region, granular, product-level modeling is especially critical to avoid over or under investment in key retail partners.

Guidelines & Guardrails: Driving Consistency and Governance

Guidelines and guardrails are parameters set by HQ teams—usually Finance, Strategy, and Executive Leadership—to ensure that the bottom-up trade plans remain aligned with business goals.

- Align guardrails with broader brand and business strategy. Guardrails should not be arbitrary, and they must reflect strategic priorities. For example, if a business strategy emphasizes margin expansion, guardrails could restrict low ROI promotions. If the goal is market share growth, you might allow more aggressive trade spend in key regions, channels, or specific Retail accounts.

- Codify and automate them within your planning system. Embedding guardrails directly into your planning solution (e.g. TPM) helps prevent errors, drive consistency and enable scalability. Planners need to be alerted when they exceed thresholds, like discount depth or frequency and the automation reduces manual oversight. This will speed up the planning cycle and make sure teams are all operating under the same rules.

- Provide visibility into the rationale behind constraints. When account teams understand why a guardrail exists, they are more likely to respect it. Include documentation, host training sessions to explain the strategic logic and even share case studies showing the impact of violating or adhering to guardrails. Education in this way builds trust and encourages smarter decision making.

- Establish training and governance workflows for exception requests. Not all situations will fit neatly into a guardrail, this is why you need training, governance workflows and approval tiers for all situations, including exceptions. Educating planners on how to apply guardrails, when to escalate and a clear process on submitting exceptions will ensure flexibility without losing control.

- Use executive teams to enforce and align exceptions. They play a critical role in reinforcing the importance of guardrails across the organization, reviewing and approving high impact exceptions in major customer investments. Executives can help ensure consistency across brands, regions and channels.

Industry Tip: For OTC medicines, pricing floors and ROI minimums are particularly important to protect brand integrity and margin during frequent or seasonal promotional windows.

Bottom-Up Planning: From Strategy to Execution

Customer Account Teams own the creation of retailer-specific trade plans, working in collaboration with Trade Marketing, Sales Finance, RGM, and HQ Strategy. Each function brings a unique lens—ranging from brand priorities and financial constraints to pricing strategy and promotional effectiveness. This collaborative approach ensures that trade plans are not only tailored to the needs of each retail partner but also aligned with broader business objectives. Once plans are built, they undergo a final review, usually by Finance and Executive Leadership to validate financial viability, strategic alignment, and resource allocation before being locked into the AOP.

Best Practices:

- Use scenarios and predictive models to streamline planning and compare options in a consistent way. Rather than starting from scratch, planners can leverage pre-configured templates and AI-driven models that simulate likely outcomes based on historical data. These tools help speed up planning cycles, ensure consistency across accounts and highlight the most effective promotional tactics based on past performance. For example, a model might suggest the optimal discount depth for a given product-retailer combination based on ROI and lift curves.

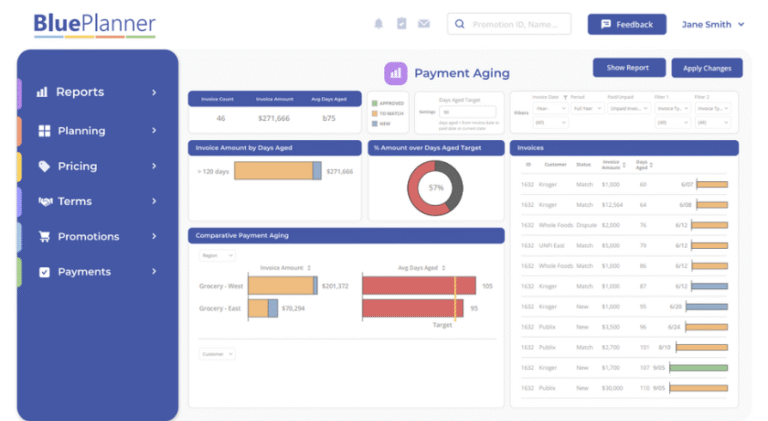

- Display near real-time KPIs as plans are built to enable data-driven decision-making. Integrating live dashboards into the planning interface allows teams to see the impact of their decisions instantly. Key metrics might include ROI, incremental volume, margin contribution, spend-to-sales ratio. This near real-time feedback loop encourages smarter, more agile planning and reduces the need for rework during reviews.

- Empower Sales through flexible tools and clear visibility into impacts. Sales teams need tools that are both user-friendly and strategically guided. Flexibility means they can adjust tactics based on retailer feedback, run “what-if” scenarios, see how changes affect KPIs and guardrails. This empowerment fosters ownership while keeping plans within strategic boundaries.

- Use executive review to finalize and consolidate plans across levels. Executive review is not just a formality—it’s a strategic checkpoint. It ensures:

- Alignment across brands, regions, and channels.

- That trade investments are prioritized based on strategic value, not just retailer demands.

- That exceptions are justified and documented.

- Consolidate plans into a cohesive, enterprise-wide trade strategy.

Industry Tip: In Health & Beauty and OTC, where product lifecycles and launches are tightly scheduled, bottom-up plans must integrate product availability, planogram resets, and retailer-specific promotional calendars.

Conclusion

Companies that rely on rigid, generalized enterprise systems often struggle to model, govern, and optimize trade plans. This is especially true in Tier 2 and Tier 3 CPGs, where trade strategy varies widely by retailer and region.

Look for specialized platforms that:

- Support top-down and bottom-up planning

- Embed modeling, KPIs, and enforcement into workflows

- Empower field teams while maintaining governance

Stand-alone TPM systems in this very niche space are more likely to produce accurate, agile, and profitable trade promotion plans. Whether or not a company selects UpClear’s BluePlanner, having the right planning system is crucial to supporting—not constraining—strategic execution.

About the Author

Based in Los Angeles, Ken Accardi is responsible for Sales in North America. Ken brings over 25 years of experience in the CPG space, specializing in Sales, Trade Management, Category Management, Sales Strategy, and business process optimization. Ken has experience in-house for leading manufacturers, partners and vendors such as Bayer Consumer Healthcare, Johnson & Johnson, Clarkston Consulting and Kantar Xtel. Ken has spent the last decade working with dozens Consumer Goods manufacturers in solution discovery, delivery, and support for TPM, TPO, and RGM capabilities. In his free time, he enjoys spending time with his daughter and hiking the many trails of Southern California.

About UpClear

At UpClear, our mission is to empower Consumer Goods brands to maximize revenue performance and trade investment returns through intelligent, collaborative software—providing a single source of truth, streamlined automation, and actionable insights.

BluePlanner Revenue Management software supports end-to-end processes, from Annual Operating Planning to Account Planning and Execution.