Helping CPG Companies Make Informed, Strategic Technology Decisions

By Ken Accardi

Executive Summary

Trade Promotion Management (TPM) is one of the most significant line items on a Consumer Packaged Goods (CPG) company’s P&L and one of the most operationally complex areas to manage. As companies evaluate solutions to better plan, execute, and analyze trade spending, the decision often comes down to selecting a specialized TPM provider or opting for a solution already embedded within their broader IT landscape. While capabilities from existing Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) vendors are convenient, this paper outlines why stand-alone platforms purpose-built for Consumer-Packaged Goods manufacturers offer superior functionality, flexibility, and long-term value.

Understanding the Trade-Offs: Existing IT Partner vs. Purpose-Built TPM Solution

Many organizations default to existing vendors in their IT stack, believing it will simplify integration, reduce procurement friction, or minimize vendor management. However, TPM is a highly specialized domain that demands functionality not typically found in generalized platforms. Below is an objective look at key considerations.

Pros of Choosing an Existing IT Landscape Vendor

- Familiarity & Consolidation: Teams are often familiar with the user interface and admin tools, and it may be easier to negotiate add-ons to an existing contract.

- Integration Perception: Assumes easier integration due to pre-existing infrastructure or shared data environment.

- IT Preference: Internal IT departments may prioritize a single platform architectural strategies.

Cons of Choosing an Existing IT Landscape Vendor

- Limited TPM Functionality: Core TPM capabilities—such as scenario planning, accrual management, and promotion ROI tracking—are often underdeveloped or missing entirely.

- Rigid Customization: General-purpose platforms require significant customization to approximate the needs of Trade Marketing and Sales teams, often increasing total cost and timeline.

- Lower User Adoption: Non-intuitive workflows and limited commercial features hinder adoption by Sales and Finance users.

- Hidden Costs: Extensive configuration, change management, and downstream support needs often outweigh the perceived cost savings.

The Case for Evaluating Specialized TPM Vendors

Standalone TPM platforms—designed specifically for the nuances of trade promotion management in the CPG industry—deliver deeper value and a faster path to ROI. Here’s why:

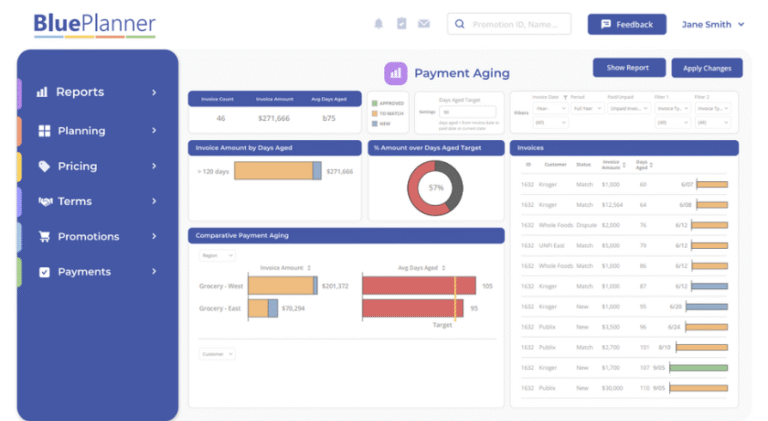

- Designed for CPG TPM Use Cases

- Solutions like UpClear’s BluePlanner are purpose-built for the workflows of Sales, Finance, and Trade Strategy teams.

- Built-in modules for planning, forecasting, deduction reconciliation, and scenario analysis reduce the need for custom development.

- Vertical Expertise

- Standalone providers are focused on CPG and have a deep understanding of the challenges in Food & Beverage, Dairy, OTC, HBA, and related categories.

- Functionality is based exclusively on CPG use cases and client (CPG manufacturers) requests resulting in industry specific best practices embedded in the solution.

- Roadmaps reflect industry evolution and regulatory changes.

- Equal Integration Effort

- Regardless of platform, TPM solutions must be integrated with ERP, Demand Planning, distributor & retailer data, CRM, and data warehouses. The level of integration effort is often equivalent, even when choosing an internal IT partner.

- Specialized vendors bring integration experience across diverse ERP platforms including SAP, Oracle, Microsoft, and others.

- Advancements in integration technologies and adoption of Application Programming Interfaces (APIs) are reducing the barriers to connecting systems.

- Speed to Value

- Faster deployments with less customization mean teams can realize benefits more quickly.

- Enhanced out-of-the-box functionality enables quicker user onboarding and adoption.

- Long-Term Flexibility

- Purpose-built TPM tools are more adaptable to changing go-to-market strategies, evolving channel dynamics, and expanded analytics needs.

Best Practice: Run a Competitive Evaluation

Even if your organization has strong relationships with enterprise IT providers, the best practice is to evaluate specialized TPM vendors side-by-side with generalist solutions. The evaluation should:

- Include stakeholders from Sales, Trade Marketing, Finance, and IT.

- Score vendors based on TPM functionality, commercial team requirements and general enterprise alignment. We recommend applying the most weight to functionality and commercial team requirements.

- Consider long-term support, scalability, and product roadmap.

- Assess user experience and ease of adoption.

Conclusion: Prioritize Fit Over Familiarity

In TPM, choosing a vendor that “fits” your organization’s long-term trade and financial goals is far more important than choosing the most familiar partner. A specialized TPM solution often results in stronger functional performance, better analytics, and greater internal adoption. While it may seem like the path of least resistance to select a module from an existing IT provider, the reality is that the integration lift is comparable—and the trade-offs can significantly hinder business impact.

By conducting a balanced, cross-functional evaluation and considering specialized TPM platforms, CPG companies of all sizes can position themselves for greater success in managing trade spend, enabling collaboration with retail partners, and driving profitable growth.

About the Author

Based in Los Angeles, Ken Accardi is responsible for Sales in North America. Ken brings over 25 years of experience in the CPG space, specializing in Sales, Trade Management, Category Management, Sales Strategy, and business process optimization. Ken has experience in-house for leading manufacturers, partners and vendors such as Bayer Consumer Healthcare, Johnson & Johnson, Clarkston Consulting and Kantar Xtel. Ken has spent the last decade working with dozens Consumer Goods manufacturers in solution discovery, delivery, and support for TPM, TPO, and RGM capabilities. In his free time, he enjoys spending time with his daughter and hiking the many trails of Southern California.

About UpClear

At UpClear, our mission is to empower Consumer Goods brands to maximize revenue performance and trade investment returns through intelligent, collaborative software—providing a single source of truth, streamlined automation, and actionable insights.

BluePlanner Revenue Management software supports end-to-end processes, from Annual Operating Planning to Account Planning and Execution.