Shipments and retail sales are different things. In CPG sales planning, the lowest common denominator is shipments. They are needed to operate. In some cases, retail sales are planned. But in most, it’s used as a backward-looking key performance indicator (KPI).

When it’s not planned, sales and spending forecasting and analysis opportunities are left on the table:

Alignment With Your Customers. Retail Sales are your (retail) customer’s language. A forecast of retail sales will help create alignment on expectations for promotion performance.

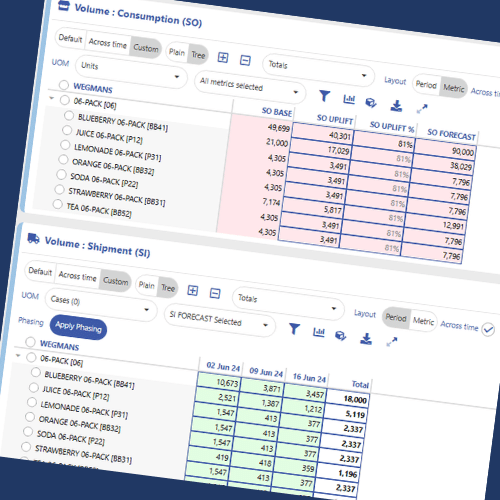

Proper Definition and Use of Base & Incremental Volume. Base and Incremental sales are fundamentally retail sales metrics. Base volume is the level of retail sales you expect when promotions are not present. Incremental volume is retail sales that are attributed to price reductions, advertising, displays and other promotion tactics. When you forecast retail sales base volume, you create a plan that is directly comparable to the actuals you acquire from retailers and syndicated data vendors.

Understanding Promotion Effectiveness. You run promotions to incentivize shoppers to purchase your product (retail sales), not to incentivize your customers to ship product. When you forecast & actualize retail sales, and learn from results, you can continuously fine tune the offers you make to shoppers. This helps you build credibility with your customers.

Improve the Accuracy of Spending Forecasts. Scan allowances are driven by retail sales. When you forecast retail sales and shipments, you can more accurately forecast spending by calculating billbacks and OI with shipments forecast, and scans on retail sales.

Understand Forward Buy Volume & Spending. Forward buy when there is an OI or billback deal is not desirable. You do not optimize profit on non-promoted sales because the product was purchased on deal. If you forecast both retail sales and shipments, you can differentiate the two types of volume and improve the accuracy of volume & spending forecasts.

For example, you may have a promotion for which you expect to sell 5,000 units/500 cases. But… a) the customer has existing inventory and will only order 400 cases, or b) the customer has a tendency to forward buy and will order 600 cases. Having discreet retail sales and shipment forecasts enables more accurate volume and spending projections.

While retail sales forecasting is desirable for all of the reasons presented above, it usually isn’t practical for all customers. The retail sales & shipment forecasting practice we see most often is based on customer segmentation. Identify where forecasting accuracy improvement, better promotion effectiveness, and client alignment will have the biggest impact. This is usually a group of “strategic” customers. Develop a strategy to create a process in which both retail sales and shipments are forecasted and actualized. Forecast and actualize scan promotion spending with retail sales, and OIs and billbacks with shipments.

To support this practice, UpClear’s BluePanner platform is designed to:

UpClear provides software solutions that help Consumer Goods brands improve gross-to-net revenue management. Sales, Operations, Finance, and Accounting from companies in different stages of growth use UpClear’s BluePlanner integrated platform for planning collaboration, visibility, automation, and intelligence. Capabilities for annual operating planning, account planning, and execution help them manage promotions, use trade spending effectively, and understand their business more comprehensively. This helps them succeed in a rapidly changing business landscape.