Why Consumer Goods Companies Should Stay the Course on Investments in Gross-to-Net Revenue Management Technology

By Ken Accardi

Executive Summary

As trade tariffs loom and inflationary pressures mount, the instinctive response for many Consumer Goods (CG) companies is to pause or delay investments—especially in areas like technology and SaaS-based operational platforms. The uncertainty around tariffs, coupled with retailer resistance to price increases, is creating a pressure cooker in the C-suite. What is needed, however, when storm clouds gather is fast, detailed, clear insight into customer investment and performance. Accurate information is needed to make decisions for the future. This is what Gross-to-Net Revenue Managment systems deliver.

This paper explores the risks of standing still and outlines the long-term benefits of continuing to invest in Gross-to-Net Revenue Management capabilities that drive efficiency, clarity, and improved financial performance—especially important in times of economic volatility. We will focus on perspectives for CFOs, CEOs, and CCOs, recognizing their unique mandates but shared need for operational resiliency and intelligent decision-making tools.

The Current Climate: A Perfect Storm of Market Uncertainty

The Consumer Goods industry is being hit from multiple angles:

- Tariff ambiguity: The timing of government policy updates are unpredictable. This leaves CPG companies with little visibility on future costs. Tariffs imposed by the United States in early-2025 were sweeping. A 25% tax on Canadian goods, and up to 245% on Chinese imports. This led to significant disruptions in supply chains and increased costs across various industries.

- Retailer pushback: Many retailers are outright rejecting tariff-related price increases, forcing CPG companies to absorb more cost or boost promotion activity. Retailers like Target and Walmart have warned that where prices are increased the change will likely be passed onto customers, affecting sales and profitability. (Source: Business Insider) Inflationary cost pressures: Increasing input costs and supply chain volatility are squeezing margins. JPMorgan’s analysis indicates that the new tariffs could lead to a 1% increase in inflation and a 0.7% reduction in GDP in 2025. (Source: Nasdaq)

- Currency volatility: Dollar fluctuations are introducing new challenges in international markets.

- Shopper reaction: Higher retail prices will change shopper behavior as they consider higher prices and make tradeoffs.

The combined effect? Chaos. For executive leadership, deprioritizing, avoiding, or cancelling technology investments in can feel like prudence. But with stagnation comes lost opportunity. And if you don’t have the right information when you need it, decisions will take longer, and you will be less informed.

CFO Perspective: Operational Efficiency is a Hedge Against Uncertainty

CFOs are understandably cautious when external variables are in flux. But the reality is: waiting for perfect visibility is a luxury no business can afford.

Key considerations:

- The cost of inefficiency compounds: Without tools to adequately manage trade spend, improve productivity, and more accurately forecast, the business bleeds margin in slow, untraceable ways.

- Increased scrutiny on ROI: In volatile markets, you need real-time visibility into what’s working—and what’s not. Investment in systems that measure promotional effectiveness and improve forecast accuracy enables better decision-making under pressure.

- Deferred investment creates backlog: Postponing modernization projects now could lead to a crunch later, where multiple investments are needed simultaneously, straining both capital and internal bandwidth.

CEO Perspective: Capability Today = Competitiveness Tomorrow

The CEO’s job is to chart a course through uncertainty, not merely wait it out. Growth doesn’t happen in a vacuum—it happens by building capacity that compounds over time.

- Agility is built, not bought at the last minute: Companies with strong operational systems in place can react faster to retailer demands, supply chain disruptions, and consumer shifts.

- SaaS scalability: Unlike physical CapEx, SaaS investment is scalable and adaptable, which allows for gradual rollouts and phased implementation aligned with business needs and resource constraints.

- Investor confidence: Public or private, stakeholders value proactive leadership. A clear plan to maintain competitiveness—even amid turbulence—instills confidence.

CCO Perspective: Trade Spend is a Strategic Lever, Not a Black Box

Chief Commercial Officers face a particularly acute challenge. When pricing flexibility is restricted by retailers, promotions become the key lever to maintain or grow volume but unmanaged; they’re also a major cost center.

Key considerations:

- Promotion spend must work harder: With inflation driving up list prices, the effectiveness of every trade dollar becomes even more important. Insights into ROI, cannibalization, lift, and deduction resolution are mission critical.

- Reactive strategies erode brand value: Over-reliance on promotions as a response to pricing pressure can damage long-term brand equity. Systems that provide holistic visibility allow for smarter planning and sustained brand integrity.

- Cross-functional coordination is critical: Gross-to-Net Revenue Management platforms enhance collaboration between sales, finance, and marketing—ensuring that promotional strategies are aligned with financial and brand goals.

The Cost of Doing Nothing

- Eroded Margins: Manual processes and blind spots in trade spend lead to inefficiencies that directly impact bottom-line performance.

- Delayed Transformation: Every quarter delayed is a quarter further from realizing the benefits of automation, integration, and strategic clarity.

- Talent Burnout: Asking teams to do more with less, without better tools, results in low morale and high turnover.

- Competitive Disadvantage: Competitors who move forward with capability-building initiatives will be better equipped to adapt, negotiate, and win.

Conclusion: Invest with Purpose, Even in Uncertain Times

Capital investments by CPG manufacturers, especially in Gross-to-Net Revenue SaaS platforms, are not a leap of faith—they are a calculated decision to improve visibility, efficiency, and competitive advantage. While it’s tempting to wait for clarity, the companies that continue investing in their operational capabilities today will be the ones leading tomorrow.

Tariffs will come and go. Market cycles will fluctuate. But the need for better decision-making, increased efficiency, and smarter trade fund investment is permanent.

The question isn’t “Can we afford to invest right now?”

It’s “Can we afford not to?”

About the Author

Based in Los Angeles, Ken Accardi is responsible for Sales in North America. Ken brings over 25 years of experience in the CPG space, specializing in Sales, Trade Management, Category Management, Sales Strategy, and business process optimization. Ken has experience in-house for leading manufacturers, partners and vendors such as Bayer Consumer Healthcare, Johnson & Johnson, Clarkston Consulting and Kantar Xtel. Ken has spent the last decade working with dozens Consumer Goods manufacturers in solution discovery, delivery, and support for TPM, TPO, and RGM capabilities. In his free time, he enjoys spending time with his daughter and hiking the many trails of Southern California.

About UpClear

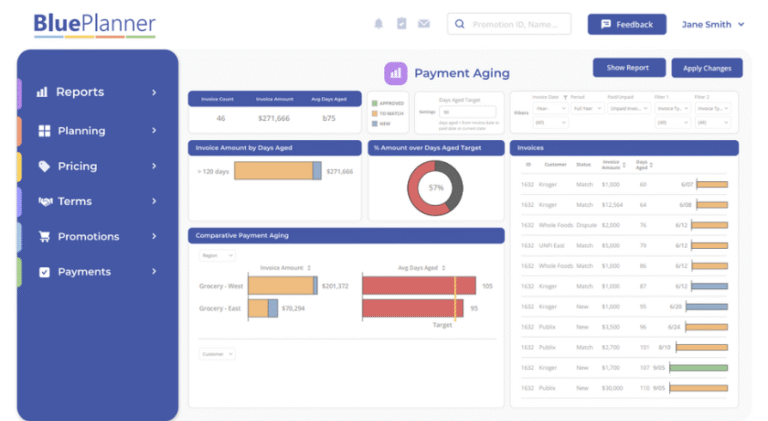

At UpClear, our mission is to empower Consumer Goods brands to maximize revenue performance and trade investment returns through intelligent, collaborative software—providing a single source of truth, streamlined automation, and actionable insights.

BluePlanner Revenue Management software supports end-to-end processes, from Annual Operating Planning to Account Planning and Execution.