From request through approval to payment, maintain audit-ready workflows with integration to AP to keep payments humming.

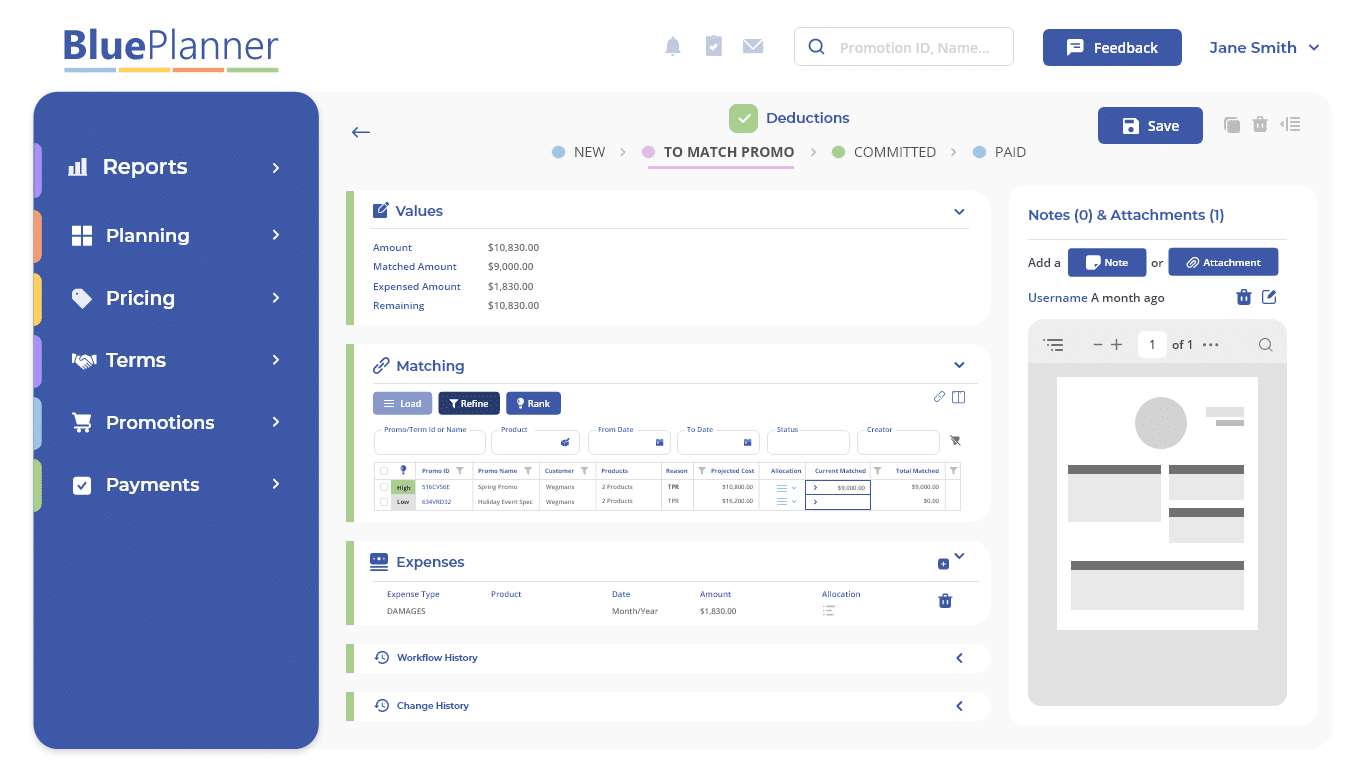

BluePlanner is designed to manage the process of settling claims from customers. This is often through deductions, but in some cases, retailers and distributors send brands an invoice that needs to be paid.

While this can easily be accomplished though the creation of a payment in Accounts Payable software, a shortcoming of this is that it does not associate that spending to the customer, product(s), and activity the spending supported (e.g. a promotion).

When BluePlanner is used, spending is first planned in Promotions and Terms (long term agreements, slotting/listing fees, etc). These activities then go through an approval process prior to commitment. Payment requests (as well as deduction processing) are then used to 1) link the actual payments to the planned spending, 2) help process the payment request, and 3) reverse the accrual that planned for the activity.

Here are the typical steps when using BluePlanner Payment/Check Request:

Ideally, BluePlanner is integrated with your Accounts Payable (A/P) system such that BluePlanner can automatically send the payment/check request to A/P after all approvals are secured. If integration is not in place, BluePlanner still provides an output with all detail needed to process the claim.

This drives three big benefits: